Summary: Many organizations are challenged to manage margins at a SKU / customer level due to 3 issues: gaps in data, the use of disparate systems without a central source of insight, and a lack of standardized margin management routines. We recommend developing a comprehensive profitability model that synthesizes disparate data and leverages business rules to address data gaps. This model, coupled with prioritizing the right management routines, provides CFOs the data agility required to develop strategic insights quickly in a changing market.

What Lies Within the Margins

By Vish Sharma, Arup Bhattacharjee, Cristina Logg

Margin visibility is key to navigating market uncertainty

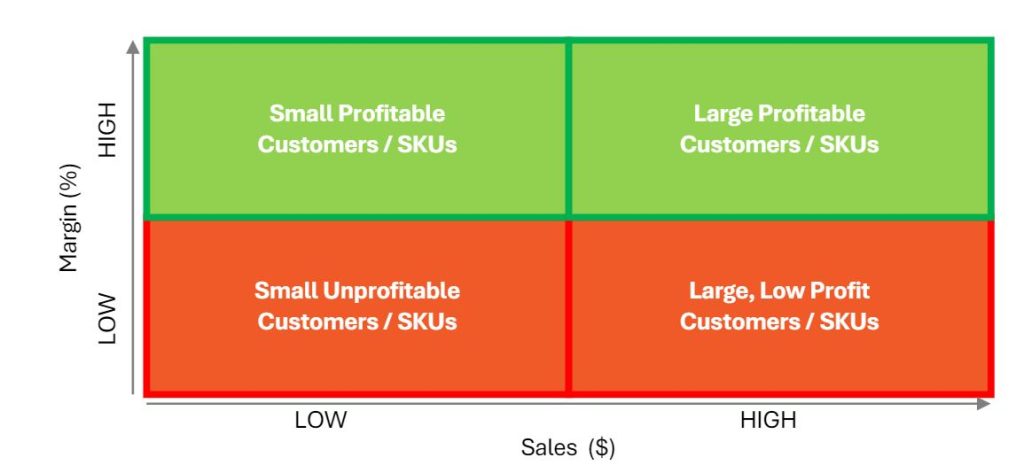

The ongoing market uncertainty, characterized by both inflationary and deflationary pressures, is anticipated to continue through 20241. This environment highlights the crucial need for true margin visibility at both the SKU and Customer level. Companies need to have complete visibility into their margin vs sales performance of their products and customers (see Margin Matrix) to be able to manage margins and make portfolio decisions. This is especially important for large suppliers with diverse portfolios in an ever-changing market landscape.

A margin matrix illustrates high-priority customers and SKUs

Common challenges of margin management

In the complex tapestry of today’s business operations, organizations face persistent obstacles in effectively managing margins at the granular levels of SKU and customer interactions. These challenges stem from a trifecta of gaps in data, systems, and processes, which collectively undermine the reliability and timeliness of financial insights2.

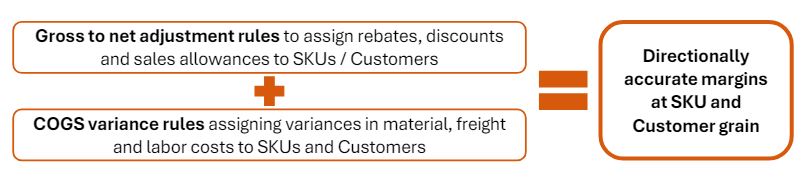

- Data Gaps – The Unseen Variables: One of the critical stumbling blocks to granular margin and net sales data is the lack of comprehensive data tracking. Essential elements such as variance factors in cost of goods sold (COGS), specific rebates, and discounts attributable directly to a specific customer / SKU often go unrecorded. These omissions mean that the fluctuations in commodity prices, labor costs, and freight charges as well as changes in discounts and rebates due to changing market dynamics — factors that can significantly impact margins — are not accurately reflected at the SKU or customer level. The absence of regular, methodical rules for attributing variances and discounts / rebates to a customer / SKU level results in decision-making based on outdated or incomplete data, leading to misguided strategies and profit erosions.

- System Gaps – The Quest for Perfection Over Accuracy: The tendency to use disparate systems exacerbates the data gap issue. Organizations frequently prioritize perfection in their data systems, seeking flawless integration and error-free records. This pursuit often comes at the expense of speed and practicality, as it leads to a lack of timely access to critical data for strategic decision making. These uncoordinated systems creates a labyrinth of data silos, where critical pieces of financial information is disconnected from each other. The quest for perfection may also lead to long-drawn technology initiatives for data integration, which promise to provide a comprehensive view of data, but only far in the future.

- Process Gaps – The Ad Hoc Approach to Margin Review and Cost Variance Tracking: In the usual routine of financial management, organizations are often tripped up by the lack of systematic processes for tracking and analyzing margins at the granular level of SKU and customer. Typically, margins are assessed at an aggregate level with one-off, reactive deep dives into margins when there is margin compression, resulting in significant outlays of time and inconsistent analyses.

Takeaway: A new approach to financial data management, comprehensive modeling, and systematic management processes are needed to get to actionable margin insights quickly. Implementing business rules and profitability models to get directionally accurate margins at SKU/ Customer grain and establishing process to regularly review margins are the keys to success.

Addressing margins effectively: The 3 elements of success

To effectively manage margins at the customer and SKU levels, suppliers must take a progressive, multi-faceted approach to data organization and financial operations:

Develop business rules to address data gaps: Effective tracking of financial adjustments like discounts, rebates, and variances is paramount in modern business practices.

Develop profitability model to act as one source of truth for margins: A centralized data model providing clear insights into net sales and margins down to the granular details of customer and SKU levels is essential to conduct agile margin management and foster a data-centric culture.

- Develop a consolidated profitability model with standardized reporting, integrating prior disparate data systems together into a “Single Source of Truth”

- Automate business rules for allocation of cost variances and assignment of rebates / margins within the integrated financial model

- Aim for 90% data coverage in the profitability model to enable quicker, insight-driven decisions, acknowledging agility often trumps perfect accuracy in a dynamic market

- For a quick, effective approach to creating a comprehensive profitability model, please view our article on iterative finance. CFOs, Turn Technology into your secret weapon

Implement profitability management: Focus regular margin management rhythms on key customers and product SKUs

- Use the comprehensive profitability model to automate reporting, with margin and net sales views produced consistently across all business units and levels at consistent granularity (e.g., key customers, SKUs, business units, products, customer types)

- Implement margin management processes with a regular rhythm of reviewing margin reports across all business units and levels with a focus on net sales and true margins at SKU and customer granularity

Conclusion: In an uncertain economy, having visibility of margins at SKU and customer level is critical for success. Adopting a pragmatic approach built on business rules, a consolidated profitability model, and a robust process will help you get there quickly.

Our experts

Vish Sharma

Managing Principal

vish@sharmastrategy.com

Vivek Narasimhan

Senior Principal

vivek@sharmastrategy.com

Arup Bhattacharjee

Senior Principal

Arup@sharmastrategy.com

Stan Cavin

Principal

Stan@sharmastrategy.com

Sources

1. “Duggan, W. (2024, January 3). Inflation outlook for 2024 Forbes Advisor.

2. Extensive Sharma Strategy Group experience across a variety of major CPG companies