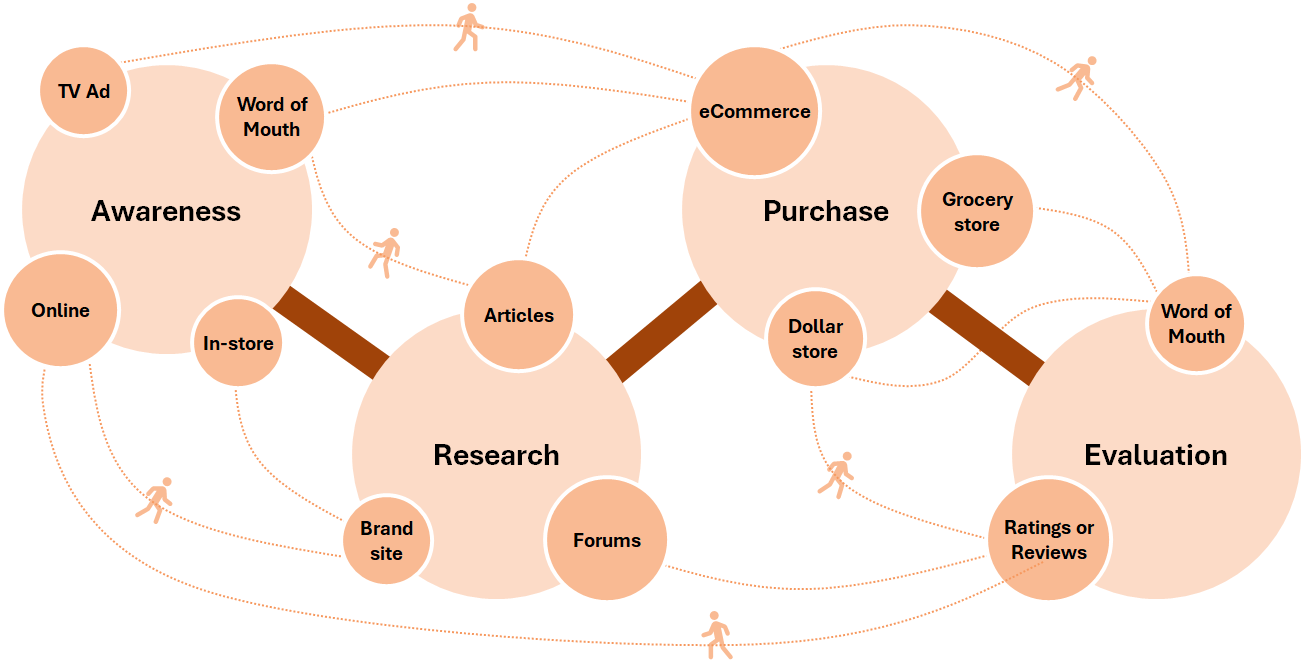

Align brand investments to the right shopper decision-making touchpoints: At one of our clients, their investment profile was such that just ~20% of the budget was allocated to media activities, while the bulk of their spend (~80%) was focused on point-of-sale (PoS) execution – development of posters and banners, retail sales staff engagement and incentives, event management, etc. This heavy-tilt on PoS had happened because of a long-held belief that consumption in this category was impulse-driven, decisions were made at the shelf, and that the success of brands in this category was proportional to the strength of the relationship with the retail sales staff (whose recommendations held sway over which brands shoppers bought). However, our granular shopper research uncovered that nearly two-thirds (~70%) of shoppers made brand purchase decisions well before ever setting foot into a store. In other words, our client’s investment mix did not reflect true shopper purchasing patterns and their spend was focused on activities which had minimal impact on conversion at the ‘last 3 feet’ (i.e., at the point of purchase). That being said, we did find that in-store paraphernalia had a different role to play – that of driving awareness and keeping the brand top-of-mind. For the client, what this meant was that they didn’t need to completely scale back on all in-store activation, just that there was a need to right-size the extent of those investments.

They went on to adjust their investment mix and, by Year 2, the client had adjusted to a more balanced 50:50 split (see Figure 2) – with a heavier lean on pre-store activities including awareness-building activities and media activation. The resulting investment boost led to more brands in the client’s portfolio reaching media sufficiency and greater household penetration – all netting out to >20% improvement in ROI versus prior years.